If you were the registered owner of a private vehicle as at midnight 30 November 2017 you may be able to claim a CTP Green Slip refund. With NRMA Third Party Property Damage Car Insurance we cover damage to your car caused by an at-fault driver up to 5000.

What Is The Difference Between Blue Pink And Green Slips

Under a reformed CTP scheme the average price of a Green Slip will be reduced by more than 100.

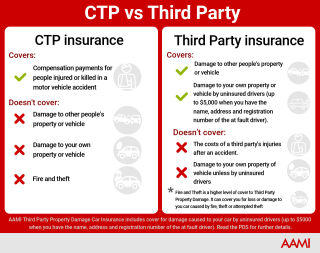

. Get an online quote for. CTP insurance known as a Green Slip in New South Wales covers the cost of third party compensation claims if you or anyone driving your car causes an accident in which someone else is injured. CTP is a mandatory policy that generally covers anyone who drives your vehicle including yourself for injuries caused to others in an at-fault motor accident.

CTP insurance also gives some cover to the driver of your vehicle if injured but at fault in a motor vehicle accident. Green Slip is the term used for Compulsory Third Party insurance CTP in NSW. Third parties who could claim against you include your passengers and other road users such as pedestrians motorcyclists cyclists other drivers and their passengers.

Eligible motorists will be refunded part of their 2017 Green Slip under the NSW Governments new compulsory third-party insurance plan.

Advertising On A Bill Is It Legal For Businesses Lawpath

Ctp Greenslips Nsw Compulsory Third Party Insurance Nsw Iselect

3 Insurance Myths Debunked Ctp Insurance Aami

Ctp Insurance Green Slips Sira

Green Slip Nsw Greenslip Ctp Insurance Greenslips Com Au

Ctp Explained Does Car Rego Include Ctp Insurance Aami

Ctp Green Slip Renewals And Payments Nrma Insurance